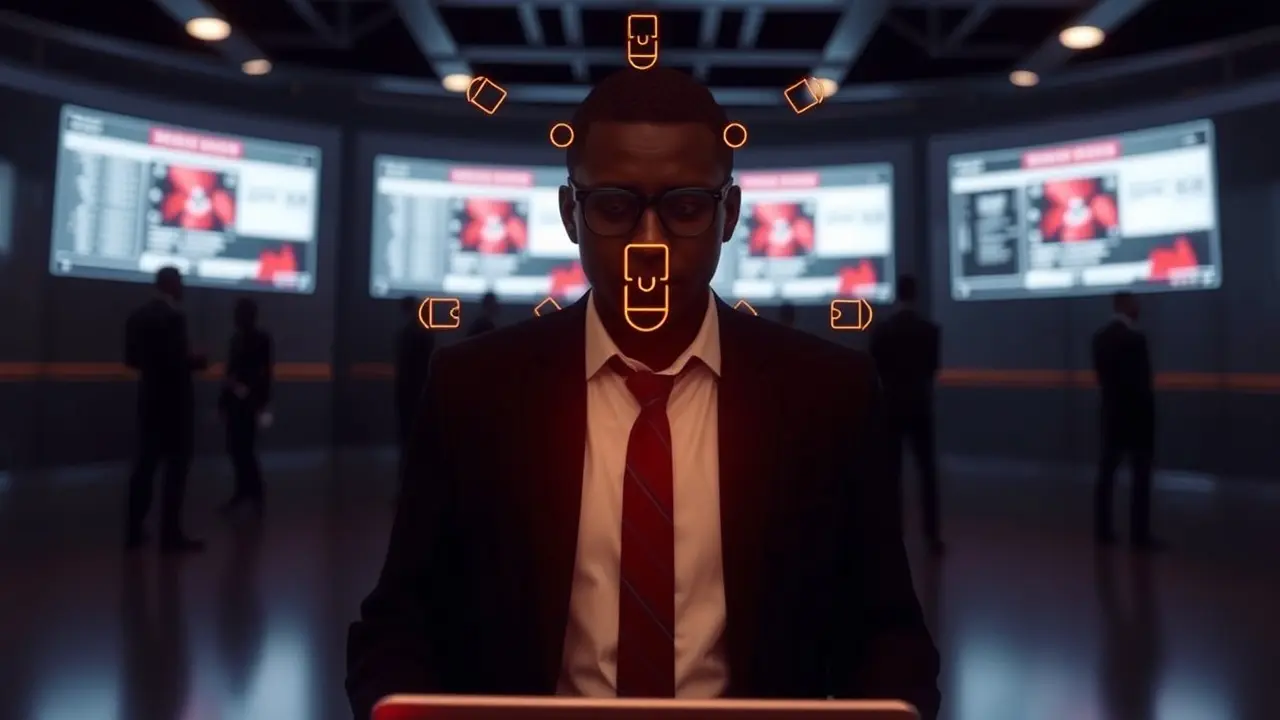

The Kenya Revenue Authority (KRA) is embracing cutting-edge technology to improve its tax collection efforts. By leveraging Artificial Intelligence (AI), the agency aims to catch tax evaders more effectively.

You might wonder how AI can help in this process. Here’s a breakdown:

- AI can analyze millions of data points quickly

- It can spot complex patterns that humans might miss

- The system flags suspicious activities in real-time

- It can examine transaction records, bank statements, and other financial data

This technological upgrade comes at a crucial time. The KRA has struggled to meet its collection targets, which affects government revenue and development plans.

Why is this important for you?

As a taxpayer, you’ll likely see more efficient and fair tax collection practices. The AI system aims to identify those who aren’t paying their fair share, potentially reducing the burden on compliant taxpayers.

Let’s look at some numbers:

| Fiscal Year | Revenue Collected | Target |

|---|---|---|

| 2023/2024 | Sh2.407 trillion | Sh2.768 trillion (original) |

| Sh2.5 trillion (revised) |

Despite an 11.1% increase in overall revenue, the KRA still fell short of its goals.

You might be wondering about the current economic climate. Kenya is facing:

- Soaring inflation

- Currency depreciation

- Weakening consumer demand

These factors make tax collection even more challenging.

The new Treasury Cabinet Secretary, John Mbadi, has urged the KRA to innovate. He emphasizes the need for:

- Continuous modernization in tax administration

- Streamlined business processes

- Cutting-edge systems

- Simplified tax transactions

“Our modernisation journey must align with our objectives and those of taxpayers,” Mbadi stated. This approach aims to benefit both taxpayers and revenue mobilization efforts.

The KRA’s Commissioner General, Humphrey Wattanga, outlined the agency’s plan to revamp its IT infrastructure. He explained how AI would strengthen their ability to identify potential tax evasion through data-driven decision-making.

The AI system will use advanced analysis and logic-based techniques to:

- Interpret events

- Supplement and automate processes

- Help the KRA take effective actions

This technological leap is part of a broader strategy. The National Tax Policy outlines the government’s tax expansion plan. Its goals include:

- Expanding the tax base

- Enhancing fairness and equity in the tax system

- Creating certainty and predictability in tax rates and bases

As a taxpayer, you can expect these changes to impact how taxes are collected and enforced. The aim is to create a more efficient and equitable system for all.

By automating complex processes, the KRA hopes to reduce errors and improve overall efficiency.

You might see changes in how you interact with the KRA. As systems become more automated, filing taxes and resolving issues could become smoother and faster.

The move towards AI is part of a global trend in tax administration. Many countries are exploring similar technologies to improve their tax collection efforts.

For the KRA, this is a significant step forward. It shows a commitment to modernizing their approach and adapting to the digital age. As a taxpayer, you’ll likely benefit from a more streamlined and fair tax system in the long run.